The tax pros are what make SDIRAs appealing For a lot of. An SDIRA may be both conventional or Roth - the account form you end up picking will rely largely with your investment and tax technique. Check with all your money advisor or tax advisor if you’re Not sure which happens to be greatest in your case.

IRAs held at banking institutions and brokerage firms provide confined investment selections to their purchasers as they don't have the know-how or infrastructure to administer alternative assets.

Complexity and Accountability: With an SDIRA, you may have much more Management around your investments, but In addition, you bear more responsibility.

Relocating resources from just one sort of account to another form of account, for example shifting money from a 401(k) to a conventional IRA.

Yes, real estate property is among our consumers’ most favored investments, from time to time called a real-estate IRA. Clients have the option to speculate in almost everything from rental Qualities, commercial real estate property, undeveloped land, house loan notes plus much more.

An SDIRA custodian differs simply because they have the appropriate personnel, skills, and capability to take care of custody with the alternative investments. Step one in opening a self-directed IRA is to locate a company that is specialized in administering accounts for alternative investments.

The primary SDIRA rules with the IRS that investors need to be familiar with are investment constraints, disqualified people, and prohibited transactions. Account holders should abide by SDIRA regulations and rules as a way to preserve the tax-advantaged status of their account.

Imagine your friend could possibly be commencing the next Facebook or Uber? Having an SDIRA, you'll be able to invest in leads to that you think in; and potentially take pleasure in higher returns.

This involves comprehension IRS polices, taking care of investments, and avoiding prohibited transactions that would disqualify your IRA. A scarcity of knowledge could cause high priced problems.

Set merely, if you’re hunting for a tax economical way to construct a portfolio that’s extra customized towards your passions and skills, an SDIRA could be the answer.

And since some SDIRAs for instance self-directed common IRAs are matter to demanded least distributions (RMDs), you’ll really need to prepare ahead in order that you've plenty of liquidity to fulfill The foundations established from the IRS.

Selection of Investment Choices: Ensure the provider enables the categories of alternative investments you’re considering, such as housing, precious metals, or personal fairness.

Nevertheless there are numerous Added benefits connected to an SDIRA, it’s not with out its own drawbacks. A few of the prevalent reasons why investors don’t decide on SDIRAs involve:

Whether you’re a economic advisor, investment issuer, or other money Skilled, explore how SDIRAs may become a powerful asset to expand your company and achieve your Expert aims.

Building essentially the most of tax-advantaged accounts permits you to hold far more of The cash that you make investments and receive. Determined anonymous by whether you choose a standard self-directed IRA or simply a Read Full Report self-directed Roth IRA, you've the probable for tax-no cost or tax-deferred progress, delivered specified ailments are fulfilled.

Several traders are astonished to understand that working with retirement cash to speculate in alternative assets has been attainable because 1974. Even so, most brokerage firms and banking companies center on providing publicly traded securities, like shares and bonds, because they lack the infrastructure and skills to manage privately held assets, including property or private fairness.

Real estate is one of the preferred choices among the SDIRA holders. That’s mainly because you could invest in any kind of housing having a self-directed IRA.

Confined Liquidity: Most of the alternative assets that may be held within an SDIRA, like real-estate, personal equity, or precious metals, is probably not quickly liquidated. This can be a difficulty if you should access cash swiftly.

Adding dollars directly to your account. Take into account that contributions are subject matter to yearly IRA contribution limitations set via the IRS.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Neve Campbell Then & Now!

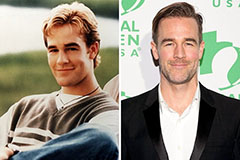

Neve Campbell Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!